If you are self-employed, you probably heard that you can save self-employment tax when you incorporate your business. But if you work outside the United States, incorporating gives you even more tax savings. As an employee of your own company you could benefit from the full Foreign Earned Income Exclusion, rather than the reduced portion that a self-employed person would get. The bite taken out of the FEIE for unincorporated business owners can be substantial, even exceeding 50%.

Self-employed entrepreneurs abroad can use the Foreign Earned Income Exclusion, but…

When working outside of the United States you probably already know about the Foreign Earned Income Exclusion (FEIE). The FEIE allows a US taxpayer to exclude up to $103,900 in income from their US income taxes for 2018. This number increases each year for inflation and will be $105,900 for 2019. To qualify, you must either spend 330 full days outside of the United States, or be a bona fide resident of a foreign country.

As long as you qualify, you can exclude income you’ve earned from self-employment using the FEIE, although you still have to pay self-employment (social security) tax. You would be eligible even if your clients are from the United States and they pay you into a US bank account.

However, using the FEIE when self-employed is not as straightforward as it seems.

… the Foreign Earned Income Exclusion works differently for a self-employed person

The way the Foreign Earned Income Exclusion is calculated is much more favorable for an employee than it is for a self-employed person.

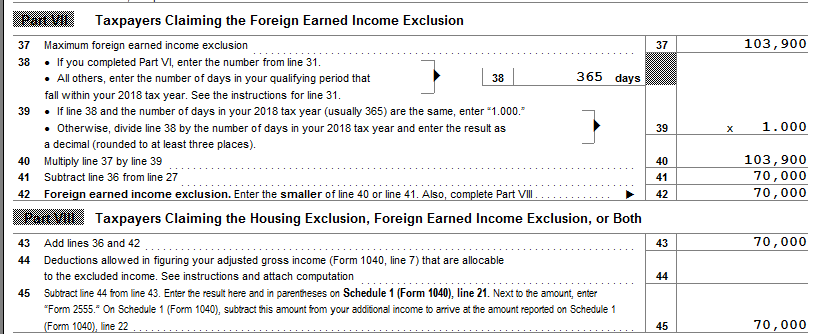

For example, let’s say you are an employee earning $70,000 each year and you qualify for the Foreign Earned Income Exclusion. In this case, you would be able to exclude all of it, and if you had no other income, you would have no US taxes. Simple, straightforward, and very favorable.

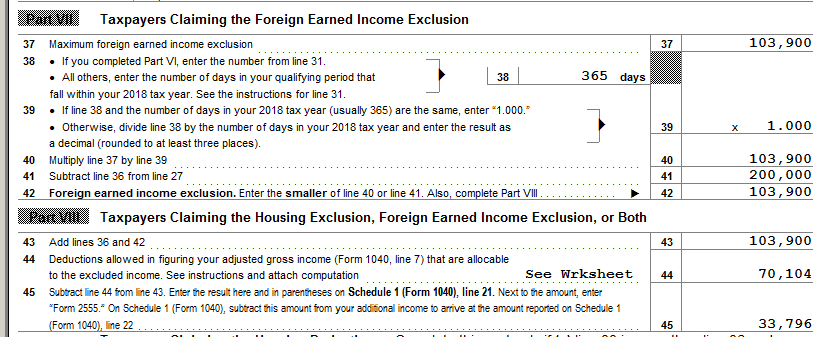

Now let’s consider a self employed person with $200,000 in gross revenue and $130,000 in expenses, leaving a net income of $70,000. Many people try to simply exclude the remaining $70,000 in net income, but unfortunately, it doesn’t work like that.

For FEIE purposes, the IRS considers your gross income. From there it reduces your exclusion based on your expenses. Basically, the higher your total expenses are relative to your income, the lower will be the allowed FEIE. This calculation takes not only the business expenses but also the employee portion of self-employment tax into account.

In this case, the Foreign Earned Income Exclusion would be reduced by more than 50%. With $70,000 in net income, the taxpayer would only be able to exclude less than $34,000.

Foreign Earned Income Exclusion Calculation for a self employed person with $200,000 in gross income and $70,000 in net income. Notice the total exclusion amount is only $33,796, not $70,000.

Foreign Earned Income Exclusion Calculation for an employee earning $70,000 from work. Notice that he can exclude the entire $70,000.

How self-employed can benefit from the full FEIE

It hardly seems fair that two similarly situated people, each earning $70,000 from their efforts, should face such different tax results. However, for the self employed person, there’s an easy solution. You can form a corporation, move your business activity to the corporation, and pay yourself a salary. That way you can get the employee treatment rather than the self employed treatment.

Be aware that not every type of company gives you that tax treatment. Even when you form a company such as a single-member LLC, the IRS may still consider you self-employed. A single-member LLC is by default taxed like a sole proprietorship. From a tax perspective, it is a disregarded entity.

You have to form a company that is not considered a disregarded entity from a tax perspective, for example an S-corporation or a C-corporation. You can also elect to have your single-member LLC taxed as a corporation.

When you work for a company that is not a disregarded entity, you are not considered self-employed for tax purposes any longer. You still set your own hours, you still act as your own boss, you still get your own clients, but you technically work for your company rather than working for yourself.

The best corporation for self-employed entrepreneurs

There are many options for forming a corporation. You can form a US corporation. There we would usually recommend a Subchapter S. Alternatively you can form a corporation outside of the United States. The best business structure really depends on your type of business. To determine the best structure for your business, please schedule a consultation with one of our Global Expat Advisors.